I recently read on the internets that 50% of Americans would experience financial ruin over a $500 expense. A simple Google search will yield several articles that show the average American has less than $1000 in savings that they have immediate access to. Yikes!

Saving money is important. The more money you keep…well, the more money you have. Notable financial gurus will tell you that one of the major keys of successful adulting is to create an emergency fund for yourself that should be any amount from $500-$2000. This money should remain untouchable and be set aside for those unexpected, rainy day expenses like car repairs, doctor bills, emergency dentistry, family emergencies—all the things that put a damper on your life and dents in your pockets.

So I encourage you reader, to build an adequate emergency fund if you haven’t already. It will make you feel good to have the money at your disposal when ish hits the fan and you know that you got you.

So where do save your money? If you are reading this article I know for sure you have access to the internets and therefore you have access to some great options. Online savings accounts are great because many of them offer the same FDIC insurance as traditional brick and mortal banks, but have even better perks like high annual percentage yields, no fees, no minimum deposit requirements and can be linked to your existing checking account so you can easily access your money. Creating a savings account at a traditional bank, say Bank of America, is great too but your interest will be little to nothing (0.01% to be exact) and they charge fees if your account doesn’t meet certain criteria.

Visit Bankrate.com for a complete listing of high yield online savings accounts. Here are a few notables:

Dollar Savings Direct: 1.40% APY (as of October 13, 2017) – Fun Fact: You can purchase real life gold bullion bars and coins through this bank—so vintage!

Ally Bank: 1.20% APY (as of October 13, 2017) – Ally Bank offers financial education and planning tools and also accepts e-checks (picture check deposits).

Syncrony Bank: 1.30% APY (as of October 13, 2017) – If you have a Syncrony Bank debit card they will offer a $5.00 rebate for withdraws made at non-Syncrony Bank ATMs.

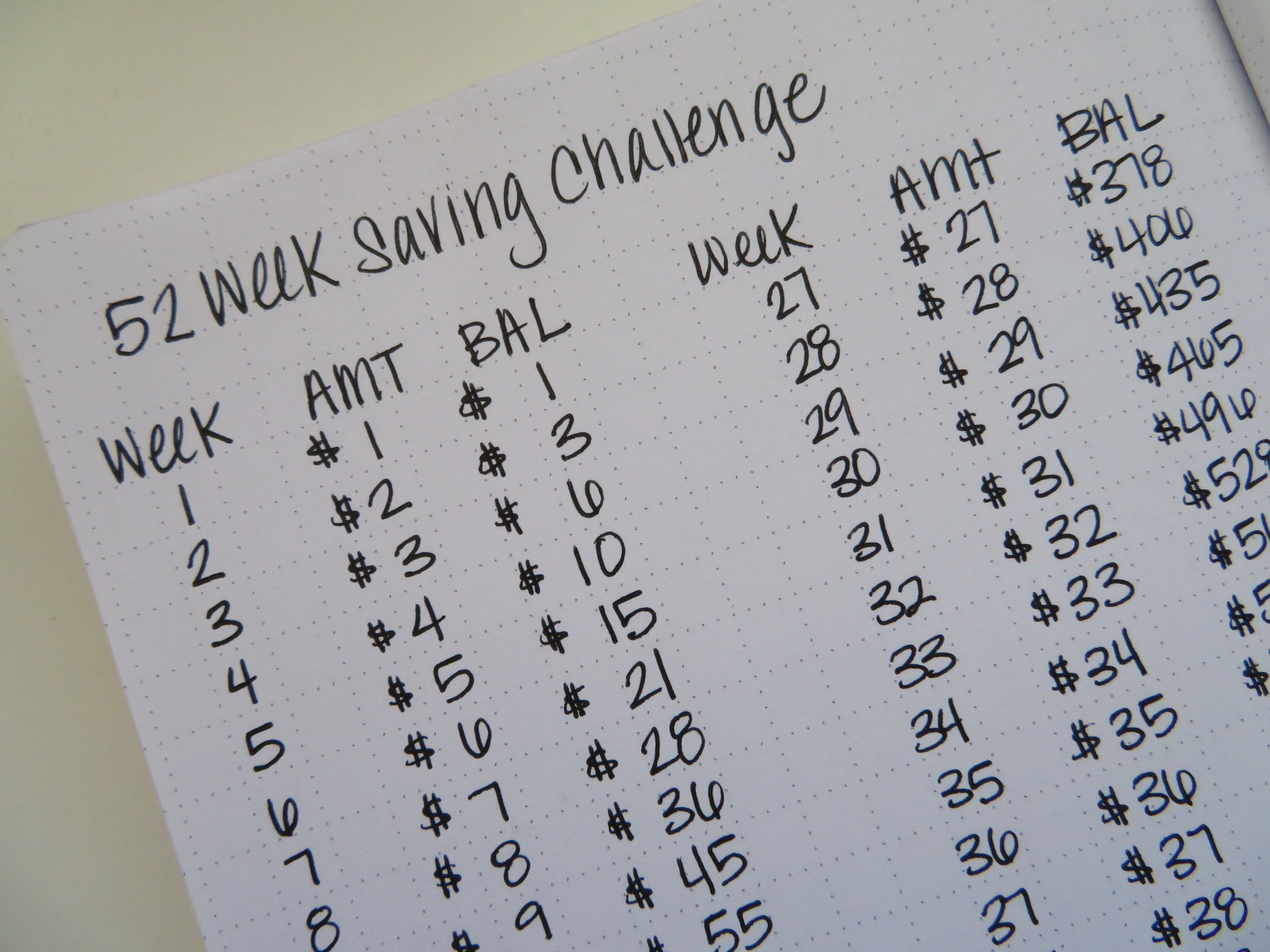

I frequently listen to personal finance guru Dave Ramsey on Youtube and I recommend you do you too. He keeps it real and is hilarious. Like Chris Rock hilarious, ok! One of the things he often explains is that personal finance is 80% behavior and only 20% education. Saving is an essential behavior you have to form that will have a huge impact on your personal financial situation and ultimately your personal well-being. If you need help building and maintaining saving as a habit, read my article about the 52 saving week challenge. Automating your savings is also an easy, low obligation, no-hassle way to pad your account.

No matter the method, you need to do it. As Dave says, “The average American is broke and stupid”. Don’t you be either.

*Disclaimer: This article is not an ad. This is my personal opinion. Your decision to utilize any of these banks should not be solely based on this article. Your decision to utilize a bank’s services should be based on your complete review of the company’s Terms and Conditions, FAQs, Prospectuses and any other legal documentation made available to the consumer.

-Khristal Talyse

Kiz,

Another good read. Personal finance is important, but you know this already being in the industry many years. I too listen to Dave Ramsey and the guy is a freakin’ hoot! Keep up the good work boo!

Thank you Shane 🙂 And–Yes! Dave Ramsey has so much great advice and keeps it all the way real–I love him!